Articles

When we are unable to raise sufficient financing growing as the intricate here, we will have discover most other sourced elements of money. To the September several, 2025, the final trade date ahead of the day for the joint proxy report/prospectus on what exchange study to own FGMC Popular Inventory is available, the new FGMC Devices signed during the $10.20, the newest FGMC Well-known Stock closed in the $9.97; plus the FGMC Legal rights finalized at the $0.26. The entire process of getting a pals public as a good business integration which have a SPAC differs from compared to taking a buddies personal because of an underwritten providing and could perform dangers for our unaffiliated investors. The brand new BOXABL board of administrators has acknowledged each one of the BOXABL Stockholder Proposals. FGMC’s board out of administrators has unanimously approved each one of the FGMC Stockholder Proposals.

Sometimes BOXABL or FGMC get terminate the newest agreement from the created find if your closing has not yet happened to your otherwise ahead of December 31, 2025 (the new “Agreement End Go out”), so long as the authority to cancel with this foundation isn’t accessible to one group whose infraction of one’s contract features proximately caused the failure of your closing that occurs from the for example time. FGMC usually attempt to slow down the chance your Sponsor often need indemnify the new Trust Membership due to states of creditors by endeavoring to own the providers, companies, prospective address companies or other entities with which FGMC really does organization, do plans with FGMC waiving people proper, label, desire or claim of any kind inside the or even to monies kept on the Trust Membership. In spite of the fresh foregoing, an excellent FGMC societal shareholder, as well as one associate of such FGMC personal shareholder otherwise one other individual that have who such as FGMC societal stockholder try pretending inside concert or because the an excellent “group” (because the laid out inside the Area 13(d)(3) of the Change Act), might possibly be minimal out of redeeming the FGMC Societal Shares in accordance to help you more than a keen aggregate away from 15.0% of your FGMC Public Shares. Appropriately, when the an excellent FGMC social stockholder, alone otherwise pretending within the show otherwise since the a team, tries so you can get more 15.0% of your FGMC Societal Offers, then these shares over one 15.0% restriction wouldn’t be used for cash. For example FGMC public shareholder, by yourself or acting within the concert or since the a group, won’t be restricted in capability to vote to possess or contrary to the Organization Combination when it comes to all of the offers.

$twenty-five Minimum Put Online casinos | Paddy Power mobile casino android

Openings and you may freshly composed directorships as a result of any increase in the newest subscribed amount of administrators is going to be filled according to the Certificate of Formation. The new tips to possess election from directors, plus the terms and you will certificates from directors, will likely be as the set forth from the Certification away from Creation. (x)As well as the conditions associated with the Area dos.5 in terms of any nomination advised getting produced during the an event, for each and every Proposing People should conform to all the appropriate criteria of your Change Work in terms of any such nominations. (cc)“Person” function anyone, connection, firm, company, limited liability company, relationship, trust, unincorporated company and other entity. Or even to including other target otherwise contact because the events could possibly get periodically employ on paper. The only hands, and you may people Governmental Expert, simultaneously, concerning the or even in contact with the fresh deals contemplated hereby.

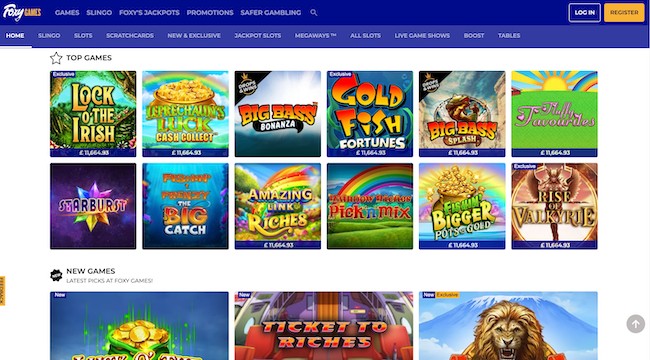

Listed below are some such special incentives!

- Many of these costs would be totally expose so you can stockholders, to the the quantity following identified, regarding the proxy solicitation material otherwise sensitive offer information provided to help you our stockholders concerning the a proposed business integration.

- Modern 5-reel video slot host video game generally element certainly one of 20 and you may twenty-five paylines stretching because of leftover to proper across the angling reels.

- The newest commitment system ‘s the biggest feature to the platform with more than 15 million consumers international.

- Meanwhile, BOXABL focused conversion in order to consumers in the says in which there’s no condition modular program in addition to conversion out of Park Design Camper Casitas.

Inability to accomplish a corporate combination perform result in FGMC and you can the fresh Faith Membership becoming liquidated, and also the Sponsor’s investment inside shares out of FGMC Well-known Stock and you may FGMC Personal Location Devices and the $15 Personal Deserves would be meaningless. For the July 31, 2025 a great deal of data for comment is distributed to per person in FGMC’s panel of directors. The new panel bundle integrated factual statements about courtroom research conducted from the Loeb and a taxation diligence conducted by the BDO. Under the NRS, FGMC stockholders commonly entitled to dissenter’s legal rights with regards to the FGMC Proposals. Any fixed otherwise changed created take action from redemption liberties should be acquired by the Continental, FGMC’s import representative, at the very least two company weeks ahead of the choose taken up the business Integration Suggestion from the FGMC Unique Fulfilling.

Consists of step 1,402,910 shares out of common stock stored by Sponsor, 85,390 offers of well-known stock held from the Ramnarain Joseph Jaigobind and you can 760,100 shares of well-known stock held from the administrators, officials and you can advisers. Likewise incorporate 22,330 and you will 2,five hundred shares away from common inventory kept from the Mentor and you can Ramnarain Joseph Jaigobind, correspondingly, root the non-public Tool Rights. The brand new FGMC Rental necessitates that FGMC’s team consolidation must be that have one or more operating businesses otherwise possessions with a reasonable market value equivalent to at least 80.0% of your web property held from the Believe Account (leaving out the amount of any deferred underwriting costs). Since August cuatro, 2025, the fresh go out of one’s execution of one’s Merger Arrangement, the balance of your Trust Account try up to $81.step three million and you may 80.0% thereof represents as much as $65.04 million. FGMC’s board out of administrators has figured the organization Consolidation matches the brand new 80.0% test. To possess low-redeeming FGMC social stockholders, there is certainly a threat your field will not contain the valuation of your own Combined Business sometimes as a result of an excellent general field downturn otherwise dangers particular to the Shared Team.

On the January 30, 2025, the business consummated their IPO of 8,100,one hundred thousand systems in the $10.00 per unit (the fresh “Units”). Per Equipment include one display of popular Paddy Power mobile casino android inventory of the Company, face value $0.0001 for every shares (“Societal Offers”) and another right to found you to definitely-10th preferred display (“Societal Correct”). The new Devices had been sold at a price out of $ten.00 for each Tool, promoting disgusting continues on the Company of $80,100,one hundred thousand.

However, we may not be limiting our stockholders’ capability to vote almost all their offers (and all shares stored by those stockholders you to hold more than 15% of one’s offers available in the IPO) for otherwise against all of our initial company consolidation. There won’t be any redemption liberties or liquidation delivery in accordance to your Business’s deserves, that will expire worthless if your Team does not over the very first company combination in the Integration months. Yet not, the initial Stockholders might possibly be eligible to liquidating withdrawals regarding the Faith Membership with regards to people Personal Shares bought throughout the otherwise following the IPO in case your Team doesn’t over their organization integration.

The procedure to have reincorporating FGMC of Vegas in order to Colorado calls for content out of conversion process (the fresh “Vegas Blogs from Conversion process”) becoming registered on the Nevada Assistant out of State and a certification away from formation and certificate or conversion (the fresh “Tx Certificate away from Formation and you can Certification from Conversion process”) as recorded to the Colorado Assistant of State from the around committed desired to the Reincorporation for taking effect. Stockholders have a tendency to experience additional dilution on the the quantity the fresh Combined Company things a lot more offers of Shared Company Popular Stock, Shared Team Merger Popular Inventory or Combined Company Well-known Inventory just after the brand new Closing. The potential detriments to BOXABL and its own associates are the enhanced will cost you and you can challenge away from working while the a public business plus the dilution of their control share inside the BOXABL down seriously to the organization Consolidation. In this instance, FGMC, their stockholders and you can affiliates perform might work with more inside the organization Integration that have BOXABL. Next desk merchandise specific pros and you may detriments of your deals on the shown functions.

- BOXABL’s organization advancement team, which is composed of product sales, product sales, social networking, customer support, bodies connections, and you can trader connections divisions is continuing to grow notably and that is already comprised from 14 lead amount, which subscribe to push BOXABL’s sales gains.

- NetEnt lay the fresh standards to possess picture and you may animations and has along with found high send-convinced with regards to game mechanics.

- This includes secure fee solutions, clear RNG (Random Number Generator) systems, and you can independent third-people audits from companies including eCOGRA and iTechLabs to confirm fairness.

For the August cuatro, 2025, after careful consideration, the fresh panel from administrators of FGMC unanimously figured the new Conversion and Team Combination is better and you may fair to help you, as well as in an informed passions out of, FGMC and its particular stockholders, and you may recommended that stockholders choose “FOR” each of the proposals displayed in the FGMC Special Meeting. For individuals who signal, time and you may get back your proxy cards as opposed to proving how you wish to in order to vote, your proxy will be chosen For each of your own proposals demonstrated in the BOXABL Special Fulfilling. If you can’t get back your proxy credit plus don’t attend the newest BOXABL Special Appointment myself, the end result was, among other things, that the shares will not be measured to possess reason for deciding whether or not a quorum is available in the BOXABL Unique Appointment and will not be voted, that will have the same impact since the a vote contrary to the BOXABL Shareholder Proposals. For individuals who sit-in the new BOXABL Unique Fulfilling individually and also you neglect to choose, the offers would be measured to have purposes of deciding if or not a good quorum can be acquired and your failure in order to vote can get the fresh exact same impression because the a ballot contrary to the BOXABL Shareholder Proposals. An abstention was counted on the quorum and certainly will provides a comparable feeling because the a ballot from the BOXABL Stockholder Proposals. If you are a stockholder away from listing therefore sit-in the new BOXABL Unique Fulfilling and would like to vote in person, you can even revoke the proxy from the sending a good revocation to help you BOXABL or from the going to the newest fulfilling and you will voting myself.

Longchamp Ce Pliage Unique

“Aggregate Preferred Stock Consideration” function including amount of Thriving Pubco Preferred Offers equivalent to the new quotient of one’s part of the Equity Really worth attributed to the fresh Business Well-known Inventory plus the number of offers out of Organization Common Inventory at the mercy of the fresh Convertible Bonds split up because of the $ten.00. “Acquiror Stockholders” function the fresh stockholders out of Acquiror by instantaneously prior to the Closing. Account (as well as people interest attained for the financing stored in the Believe Account) (since the calculated relative to Acquiror’s Governing Files) about the the newest Acquiror Exchange Proposals. “Acquiror Collection A popular Share” mode a portion of Series A preferred Stock of the Acquiror, par value $0.0001, having such conditions and terms as the are ready forward in the constitution of your own Acquiror. “2021 Consolidated Appropriations Act” form the new Consolidated Appropriations Act, 2021, or applicable regulations promulgated thereunder, since the revised from time to time.

The company is not needed to possess, nor was we engaged to do, a review of the interior command over economic reporting. As part of our audit, we have been required to obtain an understanding of inner control over economic revealing however for the intended purpose of stating an opinion on the capabilities of the Business’s internal control over financial revealing. Included in our very own review we are needed to get an comprehension of internal control over economic revealing but not to your intent behind stating an opinion to the capabilities of the Company’s interior control over financial revealing. Deferred providing will cost you consist of court, underwriter expenses and you can bookkeeping debts incurred from the equilibrium sheet go out that will be personally linked to the fresh IPO and this is charged to stockholders equity through to the conclusion of the IPO. Providing prices amounting to 1,481,032 (along with $750,100000 from underwriting commission and you may $250,100 from coach commission) was billed to investors’ equity up on the culmination of your own IPO. The new preparation from financial comments within the compliance with GAAP requires management to make estimates and presumptions affecting the new said levels of assets and you may debts and you will revelation away from contingent possessions and liabilities during the the newest date of one’s monetary statements as well as the stated levels of earnings and you will expenditures inside the revealing symptoms.

We in addition to view its withdrawal processing minutes, in order that people can be cash-out its profits rapidly and you can as opposed to trouble. These types of fine print may be somewhat distinct from you to added bonus to another, but they all the realize a similar development. We inform our very own list of the fresh no-deposit incentives each day to help you make sure that you never miss out on the newest incentives to hit the market industry. Many of these incentives had been checked out and you can verified to operate exactly as discussed inside our opinion.

At the same time, FGMC’s administrators, officers and advisors provides passions in the business Consolidation which might be not the same as, or even in addition in order to (and you will which could dispute with), their hobbies while the a stockholder. Such welfare are one FGMC’s administrators, officials and you will advisers and also the Recruit (that’s owned by clear on FGMC’s directors and you may officers and you can certain almost every other buyers) will lose the entire financing within the FGMC in the event the FGMC cannot complete a corporate combination. If you think about the newest FGMC panel from directors’ testimonial of those proposals, you should keep in mind you to definitely FGMC’s administrators and you will officials have welfare on the market Integration you to are different from, or even in addition in order to (and you will which could argument with), their welfare because the a stockholder.

Recent Comments